The Nasdaq reached an all-time high this week after reaching 9,924.75 at close on Monday June 8, effectively erasing all the losses experienced since March 2020. S&P 500 was also on track to achieve all-time highs. However, the positive momentum couldn’t find its footing, leading to all three major indices - Nasdaq Composite, S&P 500 and Dow Jones – taking a tumble amid concerns of a second-wave of coronavirus infections.

Before the tumble Thursday morning, the stock markets had been soaring despite an increasing number of social and geopolitical issues taking the main stage. Unless you live in a place with no technology, you must have come across the doomscroll showing new coronavirus cases, protests across the globe and rising tensions between the US and China (the two global powerhouses). Besides the stock market doing well, the world seems to be quite sick and need some strong cough medicine. In addition, economists have been striking a much more cautious tone and communicating relatively tepid outlook on the economy.

The disconnect between the stock market and the societal problems poses a quandary. Why was the stock market doing so well? There are a couple of reasons for this.

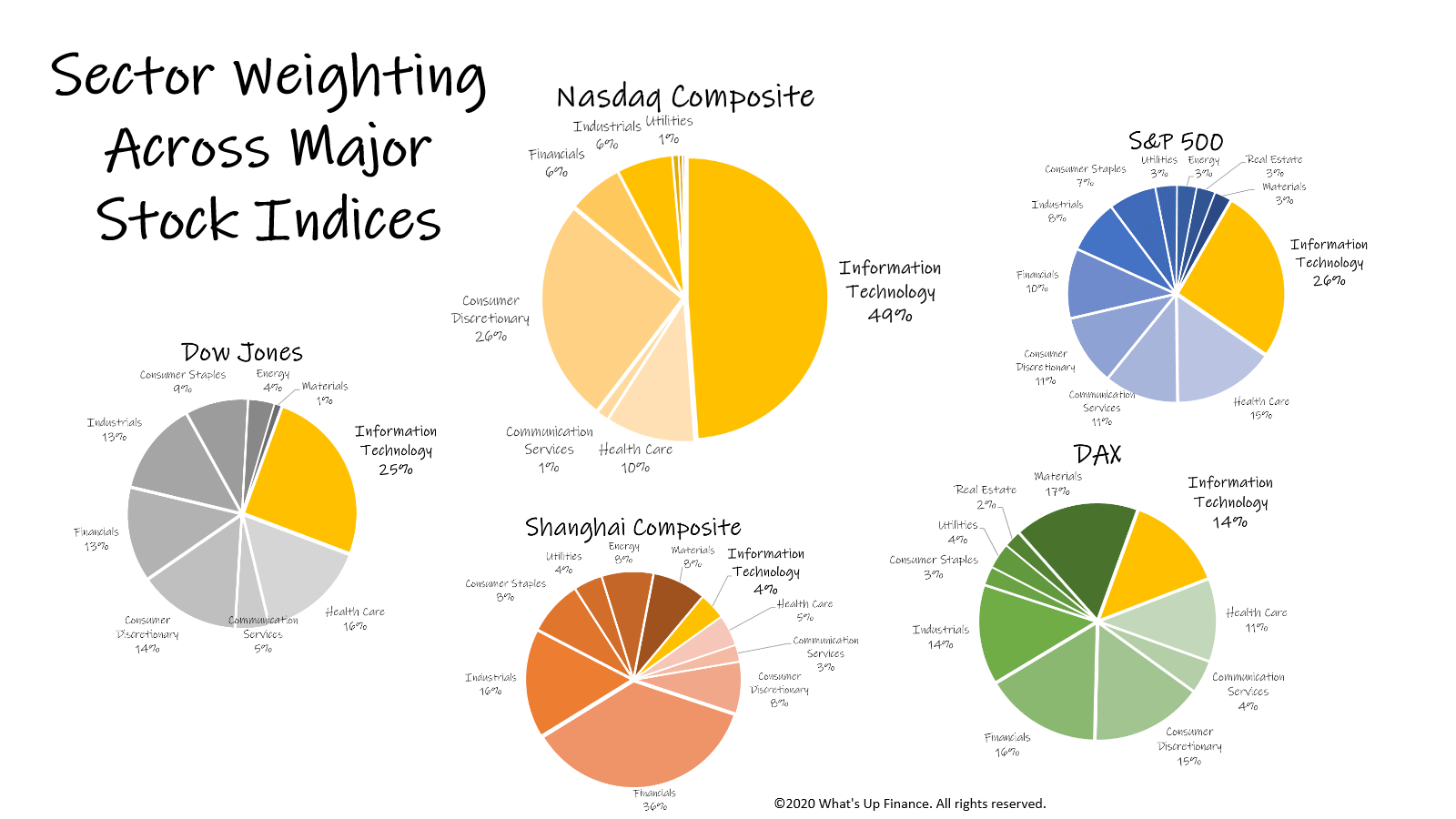

Tech Sector Skew In Major Indices

The major indices are heavily weighted towards technology companies. Information and Technology sector comprise 25.2% of Dow Jones Industrial Average, 48.9% of the Nasdaq Composite and 26.2% of S&P 500. They have been very resilient during the nationwide shutdowns. Individual investors, hedge funds and institutional investors have been piling money into fast-growing tech firms with attractive growth prospects. The rallies in major indices such as S&P 500 and Nasdaq were powered by advances from technology companies including Apple Inc. (NASDAQ: AAPL) and Amazon.com, Inc. (NASDAQ: AMZN).

Social Problems Are Not Easily Quantifiable

Investing is a complex topic involving potentially lots of mathematics and calculations, lots of emotions (behavioural finance) and sometimes just plain intuition. For those who trade and invest using valuation methods and other technical analyses, it is just difficult to trade civil disorder. The 3 p’s – pandemic, protests, politics – don’t directly affect markets in the sense that there are no obvious stocks to buy and sell purely because of the public unrest. Sure, the 3 p’s affect businesses, influence voting decisions etc. but in the grand scheme of things, investors are much more likely to trade on momentum and how much relief package the government is providing instead.

Optimism for Endless Stimulus

Since the initial outbreak, governments and central banks across major economies have been offering unprecedented level of stimulus. Investors are betting that the stimulus offered will be enough to offset temporary dip in business activity. The market seems to be increasingly hinging on the words and actions of the Federal Reserve and its counterparts internationally as a gauge of buy/sell decisions. The investors are still factoring in additional government stimulus from yet another coronavirus relief package. While certain level of stimulus is needed in times like these, the tap of money flowing will eventually run out. As a matter of fact, most of the stimulus package has already been depleted. How will the market react if there is no additional stimulus package in the foreseeable future?

These are some explanations behind why there appears to be a disconnect between the rising stock market and the prevalence of social and political issues.