Oil is widely considered to be the world’s most important commodity. Last week, oil splashed headlines across major publications across the world as the price of oil fell below zero for the first time… ever.

Before we dive into exactly why the price of oil was trading below zero, let us take a step back to discuss the basics first so you have the foundation to understand how the oil market works.

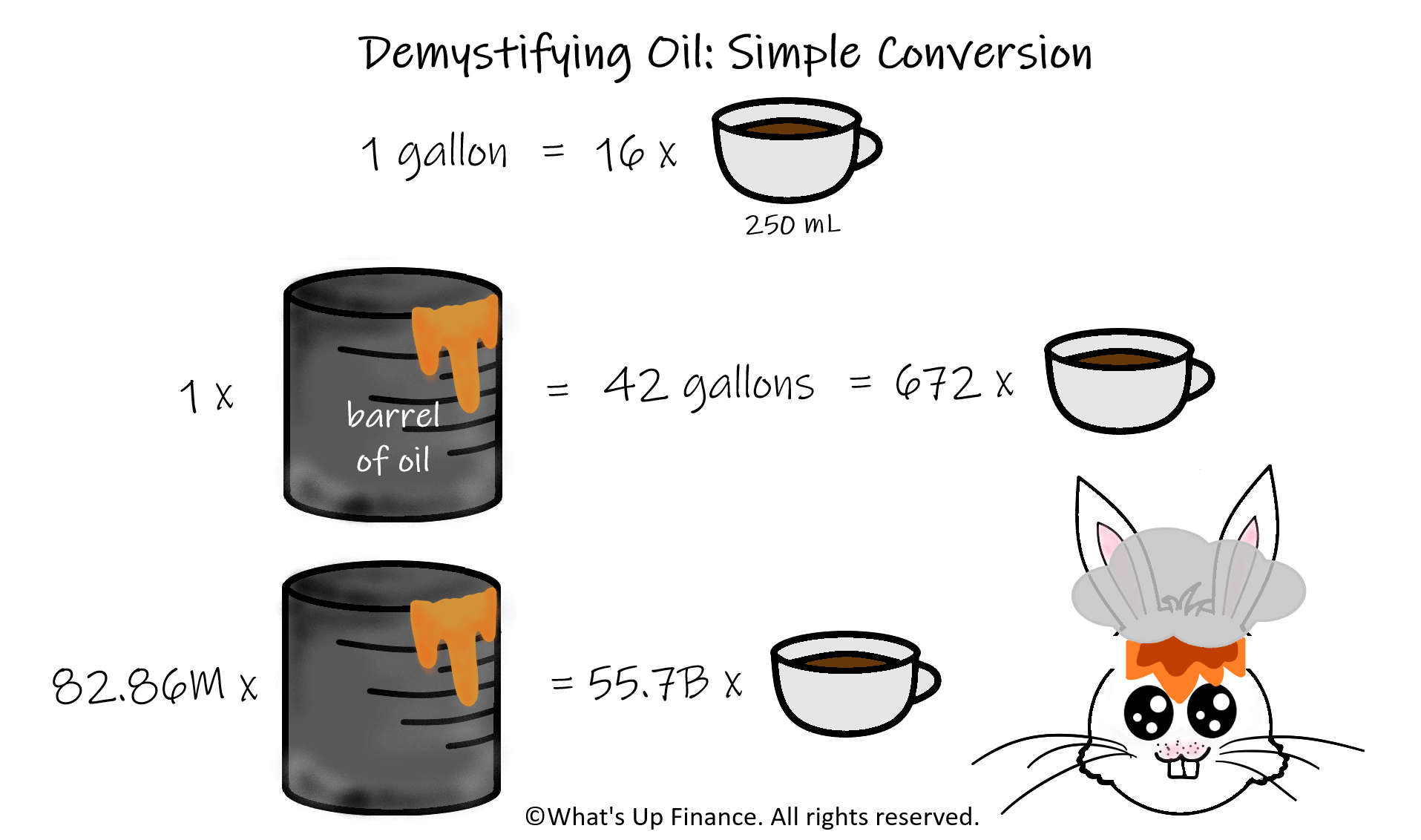

When people talk about oil production, they are likely referring to crude oil production. Current crude oil production is at 82.86 million barrels per day (bbl/d) (as of January 2020, the latest data available). How much is exactly in a barrel? That’s a great question. A barrel contains 42 gallons of crude oil. 1 US liquid gallon is equivalent to 16 cups. So 1 barrel contains 42 gallons, which is equivalent to 672 cups. So daily world crude oil production of 82.86M barrels is equivalent to 55.7 billion cups of oil! Remember this is a daily figure.

Why is oil so important?

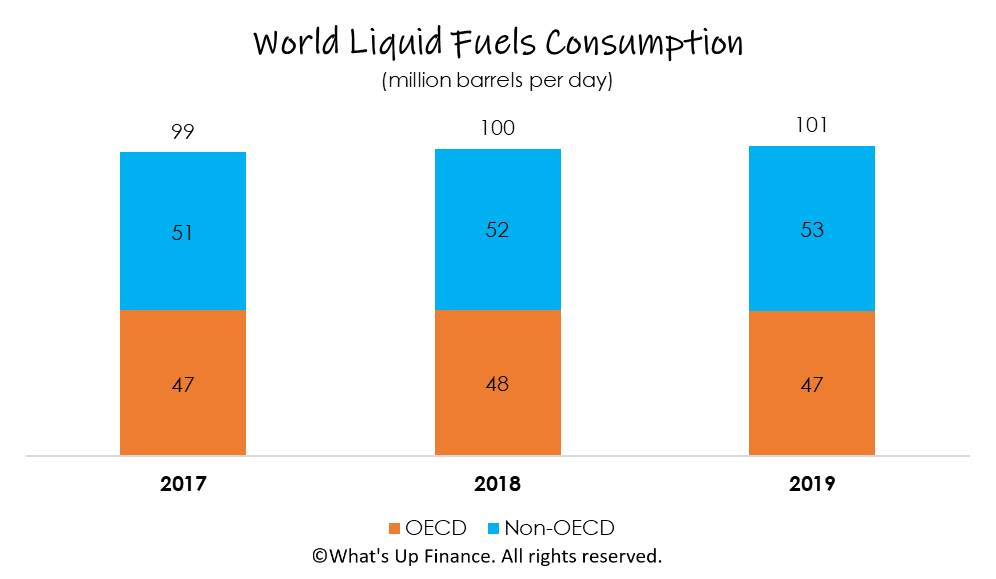

Oil has become the world’s most important source of energy since the mid-1950s. It is one of the key reasons why the world is truly globalized. Despite the increasing proliferation of alternative energy sources (i.e. green or renewable energy sources), oil production continues to play an important role in the global economy. Majority of transportation modes still rely heavily on derivatives of oil. Vehicles people drive, planes people take to go travel for work, for pleasure, or to write a travel blog. These transportation modes use oil derivatives to transport people and goods from place A to place B. To put things into perspective, the 2019 fuel consumption averaged 101 million bbl/d. Note that you cannot just put crude oil into cars and planes. Crude oil needs to go through a refining process before they are in a form (such as gasoline, diesel fuels) that we, as end consumers, are more familiar with.

So what happened to oil prices? Where did it all go wrong?

This boils down to, unsurprisingly, a supply and demand issue. This time, both forces have been at play.

Let us look at demand first. When coronavirus became a global pandemic and countries started implementing lockdowns, consumption of gasoline fell to its lowest level in 30 years. Global demand for crude oil has halved. People are not flying to Rome to see to the Colosseum no more. In fact, the Italian mayors will cuss at you if you do.

Things were not looking rosy on the supply side either. Saudi Arabia and Russia, two major producers of crude oil, were at an oil price war in March 2020. This drove oil prices down dramatically. While the US (the world’s largest producer of crude oil) was not directly involved in the price war, US producers continued to pump oil while the price of oil slumped. As a result, oil has been piling up with nowhere to go. It reached the point where the storage tanks were filled at the brim.

The slump in demand coupled with increased supply resulted in a disaster for oil prices. The demand and supply mismatch reached a point where investors and traders with obligations to buy the barrels of oil would rather pay someone to take the oil off their hands. Common sense would suggest that traders and investors do not even want 1 barrel, or 672 cups, of crude oil sitting in their kitchen.

The next series of posts will be focused on oil! It is certainly a complex yet interesting topic! Stay tuned!